Short Summary: Discover how AI empowers SMEs to fight financial crime with real-time fraud detection, AML compliance, and predictive security. Learn why AI is becoming essential for small businesses.

The small and medium-sized enterprises (SMEs) are commonly known as the backbone of the global economy. They spur growth, generate employment and introduce innovation in markets. Nevertheless, they are prone to financial crime due to their growing significance. In contrast to big companies, SMEs tend to have no massive compliance divisions, advanced fraud detection tools, or massive cybersecurity funds. These loopholes allow criminals to exploit SMEs to money laundering, fraud, identity theft, and cybercrime.

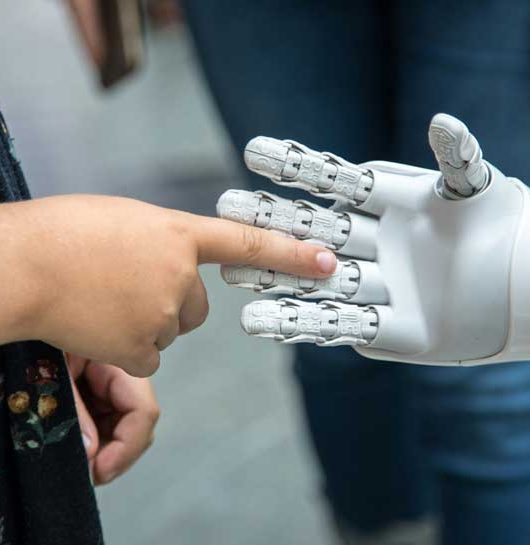

Artificial intelligence (AI) has become a strong partner of SMEs in recent years. AI is assisting smaller businesses to defend themselves better, comply with regulatory requirements, and stop financial crime more efficiently by machine learning, predictive analytics, and natural language processing.

The reason why SMEs are attractive targets of financial criminals

There is an increasing trend of financial crime against SMEs, in part due to the fact that they are perceived as easier by criminals. A smaller company might lack specialized compliance personnel, sophisticated fraud detection software, and other resources to pursue suspicious activity. Their vulnerability is increased by manual procedures, use of old tools, and lack of awareness on emerging risks.

As an example, a small export business may get involved in a money laundering chain without even noticing it unless it has screened a new international client appropriately. Equally, payment fraud, phishing attacks, and insider threats have higher chances of remaining unnoticed in cases where human oversight is the sole means of control among businesses.

The Transformative AI in Preventing Financial Crime

Artificial intelligence offers SMEs with technology-driven solutions which are beyond human capability. In contrast to a classic system, AI is not only a continuous learner but also able to adjust to emerging threats and identify the patterns that a human eye might not notice. The following are some of the ways in which AI is changing the financial crime prevention among SMEs:

Detecting Fraud in Real Time

AI is able to handle thousands of transactions in one second detecting abnormal behavior and anomalies. An example is when an employee tries to send money to an account that he or she has never used before or when there is an immediate shift in the purchasing pattern, the AI systems will raise a red flag. This is a real-time monitoring that prevents fraud in a business before losses are incurred.

Enhancement of Customer Due Diligence (CDD).

It is not safe to board on new customers, suppliers, or partners without conducting background checks. AI-driven tools are able to process large volumes of data, such as global sanction lists, watchlists, and negative media sources, in a short period of time. This helps SMEs to be aware of the individuals they are doing business with thus minimizing chances of dealing with bad actors or politically exposed persons (PEPs).

Fighting Money Laundering

Money laundering is usually a set of complicated and multi-layered transactions that conceal illegal sources. AI is able to monitor trends within accounts and regions to identify suspicious transactions that reflect laundering. In the case of SMEs, it does not require them to employ huge compliance teams to comply with anti-money laundering (AML) laws.

Enhancing Cybersecurity

Another significant threat is cyber-enabled financial crimes. The AI-enabled cybersecurity systems detect suspicious logins, phishing, or unauthorized access to sensitive information. Through behavioral patterns, AI will offer SMEs a predictive shield that will become more robust with each attack.

The main advantages of AI Adoption to SMEs.

The use of AI extends beyond the prevention of financial crime. It offers SMEs several benefits that lead to growth, resilience and competitiveness. The following are some of the most prominent advantages:

Customer Trust: Secure transactions will establish better relationships with clients and partners.

Cost Efficiency: AI will reduce the size of compliance teams, which will decrease operational costs.

Quickening the decision-making process: Predictive analytics inform business strategies and risk management.

Regulatory Readiness: AI makes sure that it is in line with AML, KYC, and cybersecurity regulations.

Competitive Edge: AI signal sends a message to the market that SMEs are credible and reliable.

These advantages indicate that AI is not all about protection only, but also an enabler of growth.

The ways AI makes compliance easier among SMEs

Smaller businesses are overburdened by regulatory compliance, whereas AI simplifies the process by automating time-consuming activities. AI systems automate customer screening or generating long reports instead of manually screening each customer or creating long reports.

As an example, an AI solution can automatically search new customer information with sanctions databases, minimizing the likelihood of oversight. It is also able to generate correct suspicious activity reports (SARS), which save time and reduce the chances of being punished due to lack of compliance. In addition, AI tools have digital records and audit trails, which simplify and streamline regulatory audits.

Applications of AI in SMEs in the Real World

The practical application of AI is already apparent in the operations of different SMEs. Machine learning payment gateways identify fraudulent credit card transactions. Fintech applications apply AI to assess the credibility of loan borrowers, minimizing loan fraud. Other SMEs also use AI-based chatbots that assist employees with compliance mandates by providing real-time advice.

In other sectors, such as retail or logistics, AI is being applied to detect abnormal behavior on the side of suppliers, suspicious account usage, or fraudulent refunds. These practical uses show that AI is not only applicable to banks or multinational corporations but it is available and useful to SMEs in any industry.

Difficulties that SMEs have to overcome

Although AI promises, there are SMEs who are reluctant because of the perceived cost, technicality, or expertise. Implementation of AI systems can be overwhelming particularly to a business that does not have an in-house IT or compliance department. Nevertheless, as the affordable AI-as-a-service (AIaaS) solutions and cloud-based platforms have grown, now SMEs can access AI tools without huge investments.

The other issue is the question of integrating AI with the current systems. Effective implementation involves effective staff training and goal alignment to the overall business objectives. Those SMEs that manage to cross these challenges tend to have the long term benefits way more than the first hurdles.

Prospects: AI as a Commonplace Defense

With the rise of more advanced financial crime, SMEs will be left with no option but to use AI in their defense mechanism. Advanced technologies are being used by the criminals to take advantage of the weak points and businesses have to follow suit. AI solutions will be more accessible, customizable and affordable in the future, becoming a common tool to be used by SMEs globally.

The emergence of regulations like AML guidelines, data protection, and cybersecurity compliance models also necessitate the adoption of AI. In the case of SMEs, the integration of AI will not only be protection-related, but also be competitive and compliant in a digital-first economy.

Conclusion

Small and medium-sized enterprises are at a significant risk of financial crime, however, artificial intelligence is coming to the rescue and providing a level playing field. AI enables SMEs to conduct business with confidence through the provision of real-time fraud detection, enhanced compliance procedures, and predictive security against cybercrime. In addition to protection, the use of AI instills trust, improves reputation, and leads to growth.

In the current dynamic financial world, SMEs that are adopting AI are not just avoiding crime- they are equipping themselves to succeed in the long-term in the safer, smarter and more competitive business world.